Nigeria’s booming ICT sector, rich digital entrepreneurial ecosystem and track record in emerging technologies show unique promise. Enhancing network readiness for all Nigerian individuals, businesses and levels of government will help Nigeria become a decisive tech leader on the African continent.

As recorded in a previous Portulans deep-dive analytical article on Africa’s digital economies, Nigeria is a constituent economy in what digital innovation thought leader Eric Osiakwan calls “Africa’s KINGS” – a group of African economies (Kenya, Ivory Coast, Nigeria, Ghana and South Africa) driving an “unstoppable wave of technological innovation” for the continent. Particularly in the field of digital entrepreneurship, Nigeria demonstrates optimistic levels of digital, or network, readiness.

By using the Network Readiness Index (NRI) and other index-based assessments to diagnose the economy’s ‘green flags’ and ‘red flags’, practitioners, policymakers and private sector leaders can chart a course for homegrown digital innovation excellence, keeping the country and its diverse communities ahead of the curve of digital progress and combating long-standing societal issues.

Compared to other African economies surveyed by the 2020 NRI, Nigeria ranks in 15th place, just behind Uganda, Ivory Coast and Zambia (the African continent’s three NRI leaders are Mauritius, South Africa and Kenya, in 61st, 76th and 82nd places, respectively). Globally, Nigeria ranks 117th out of 134 economies. Compared to its overall ranking, Nigeria’s main strength relates to the People (99th) pillar, while its weaknesses relate to Technology and Impact (124th and 125th place, respectively).

This picture is reflected by Nigeria’s sub-par performance in various aspects of digital connectivity. While the Nigerian Communications Commission records that over 96 percent of the population are internet users, barriers to access remain. In particular, many rural areas suffer from patchy broadband coverage; nationally, the mean download speed is just 1.56 Mbps, one of the lowest in the world, and a particular red flag for Africa’s largest tech market. In the NRI, internet access (129th place) and international internet bandwidth (130th) are two of Nigeria’s worst indicators, which undoubtedly exacerbates the nation’s severe levels of income, gender and regional inequalities (in the NRI, Nigeria is also ranked 122nd for the digital Inclusion sub-pillar). As commented by World Bank’s ‘digital diagnostic’ report on Nigeria, to harness the promise of Africa’s largest mobile market, Nigeria needs to take steps to build better connectivity infrastructure, digital platforms, stronger regulation and enhanced access to mobile financial services: “through innovations and investments, the Nigerian economy can harness digital data and new technologies.”

Data-driven analysis points to several impressive areas of performance in the field of digital innovation and network readiness: strengths that may present the keys to tackling Nigeria’s barriers to network readiness. One of these is Nigeria’s flourishing tech start-up ecosystem. According to UNCTAD data and the 2019 Digital Economy report, Nigeria is among four economies (including Egypt, South Africa and Kenya) that account for 60 percent of digital entrepreneurial activities in Africa. Nigerian’s digital entrepreneurs are part of a generation exploring “creative solutions to fill gaps left by the state”, with impressive innovations in edutech, fintech and healthtech combating gaps in governance. As a result, Nigeria also has the continent’s second-highest density of tech-startups. In the NRI, Nigeria’s ‘Business’ sub-pillar (with indicators including the ease of doing businesses, use of digital tools and websites) significantly outperforms expectations for its lower-middle income group, ranked in 53rd place globally. Nigerian businesses’ use of digital tools – an indicator designed to capture how future-ready a country’s firms are – also performs strongly, ranked in 50th place worldwide. Businesses like Jumia Nigeria, an e-commerce platform founded in 2012, serve as case studies of Nigeria’s highly competitive, needs-based digital innovation and investment culture.

Nigeria’s flourishing digital innovation in the private sector is relatively well-supported by substantial levels of ICTs trust and promising governance, which also outperform Nigeria’s overall ranking. In particular, the recently launched National Digital Economy Policy and Strategy (2020-2030) shows great promise to improve Nigeria’s existing ICT regulation, building the pillars of an inclusive digital society. In the meantime, Nigeria’s pre-existing track record in e-commerce (with e-commerce legislation ranked in 77th place worldwide, although some gaps remain) may provide the regulatory and infrastructural groundwork and incentives to further enhance trust and governance: Nigeria is in fact one of Africa’s most substantial internet economies, with nearly 80 million online shoppers.

Finally, Nigeria is emerging as a hub for future technologies like AI. As previously mentioned, Nigeria’s ICT sector has boomed in the past two decades, from less than 1 percent of GDP in 2000 to almost 10 percent of GDP in recent years, surpassing South Africa to emerge as Africa’s main ICT investment destination and hosting over 55 active tech hubs. Local innovators are now turning to Fourth Industrial Revolution technologies like AI as a means to develop Nigeria’s ICT sector further. In September last year, the government launched the Center for Artificial Intelligence and Robotics to offer skills and training courses for students and professionals; in the non-profit sector, organizations like Data Science Nigeria have pledged to train one million Nigerians in AI and machine learning in the next ten years. NRI data reflects this optimism: Nigeria ranks highly for its existing medium and high-tech industry (43rd place) and for the government’s adoption of emerging technologies (74th place). As for competitive talent, Nigeria actually ranks in 4th place worldwide for its concentration of technicians and associate professionals.

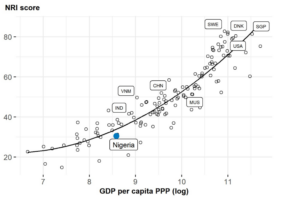

Despite Nigeria’s noted strengths, NRI analysis suggests that Nigeria is underperforming according to its GDP. As demonstrated by the trend line, there is a positive correlation between a country’s GDP and its levels of network readiness, which accounts for why high-income countries perform so competitively on the NRI (according to the 2020 NRI, this trend is being slightly disrupted by economies, like the People’s Republic of China). Among other things, this suggests that its level of economic development may enable it to enhance its levels of network readiness in the coming years.

By investing in its homegrown digital entrepreneurial ecosystem with network-ready businesses, using the momentum of e-commerce and the new National Digital Economy Policy and Strategy to build effective regulation and infrastructure, riding the wave of emerging technologies, and tackling its long-standing barriers to connectivity, Nigeria can improve its tech competitiveness both in Africa and on a global level.

This blog is part of the ‘NRI Regional Spotlight’ series: a series in which Portulans staff use the Network Readiness Index data and findings to produce targeted analysis and commentary (in addition to insights from the Global Innovation Index and the Global Talent Competitiveness Index). Interested in a deep-dive into your country’s tech competitiveness, innovation readiness and global talent? Email info@portulansinstitute.org.