Over the next year, the Portulans Institute plans to release a blog series analyzing some of the most thought-provoking books on the topics of global technology, innovation, and talent. Interviews with the authors will be included.

For this first edition, we interviewed Prof. Lourdes Casanova and Prof. Anne Miroux, authors of the book The Era of Chinese Multinationals Competing for Global Dominance.

Chinese Innovation

In 2019, the Network Readiness Index (NRI) (China’s position: 41st out of 121), the Global Talent Competitiveness Index (GTCI) (42nd out of 132), and the Global Innovation Index (GII) (14th out of 129) all found that China performs particularly well in fields such as artificial intelligence, formal education, 5G technology, and innovation outputs.

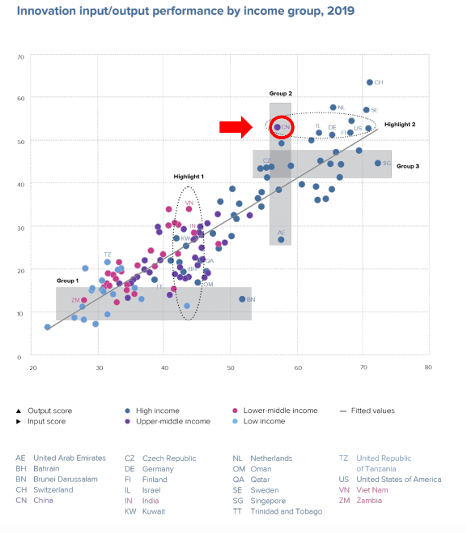

Interestingly, China performs better in innovation outputs than inputs. Economies (see graphic below) appearing above the line are effectively translating their costly innovation investments into more and higher-quality outputs. In contrast, those below the line are not effectively translating innovation inputs into outputs.

While China’s initial strategy for the growth of their companies was based on imitation, recent years have seen the country evolve towards a strategy of innovation and outward investment.

While China’s initial strategy for the growth of their companies was based on imitation, recent years have seen the country evolve towards a strategy of innovation and outward investment.

An example of China’s strength in industries centered around knowledge, innovation, and technology is Ping An Insurance. Although unknown to many outside of China, Ping An is, in fact, the world’s largest health and life insurance company. Casanova and Miroux account for Ping An’s rapid growth by arguing that they have “used data mining and artificial intelligence in order to be able to sort and process insurance claims in hours. They have been able to do this due to investments in A.I and data analytics.”

Another example is Ant Financial, a Chinese company that is creating a new template for the twenty-first-century innovative firm by leveraging digital scale and scope, adopting long-term partnerships through a platform model, and thus transforming the financial sector.

One of the main lessons drawn from the Chinese experience with innovation is that learning by doing is crucial, as is focusing on small and incremental innovation. As founder and CEO of Chinese technology conglomerate Tencent, Ma Huateng, “In America, when you bring an idea to market, you usually have several months before competition pops up, allowing you to capture significant market share. In China, you can have hundreds of competitors within the first hours of going live. Ideas are not important in China – execution is.”

The Competitiveness of Chinese Companies

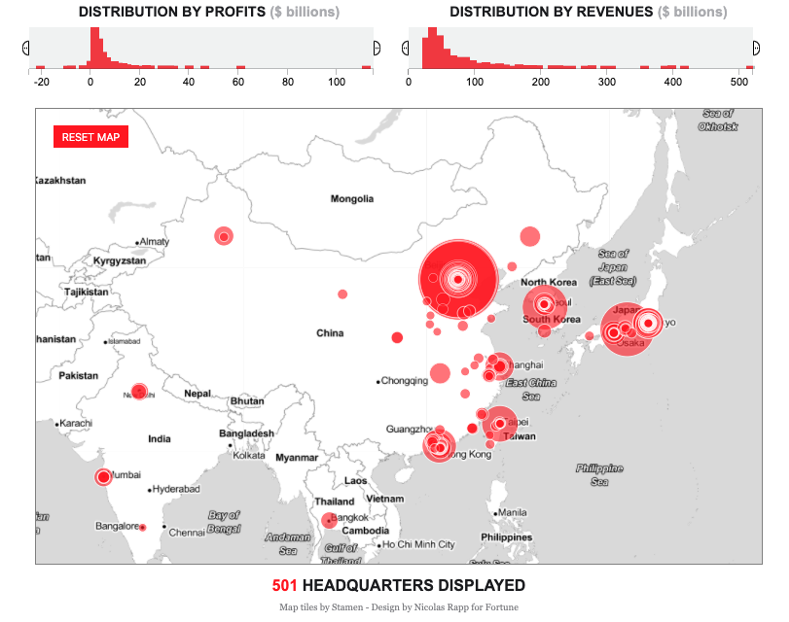

In the Fortune Global 500, for the first time since its creation, a nation has challenged the U.S. for the top of the ranks of global big business. Chinese companies (119) have essentially matched the number of American companies (121). Casanova and Miroux argue that “this is an incredible achievement for China, given their GDP per capita.”

Globally, only 21 countries have more than one company in the Forbes Global 500. Casanova and Miroux state that “China is clearly an outlier here since it has more large companies than what its GDP per capita would suggest.”

To explain this phenomenon, Casanova and Miroux analyze the ways in which China has actively supported outward foreign direct investment (OFDI) in recent years. In 2018, China was already the second highest OFDI investor, surpassed only by Japan. This is remarkable, since China is still an emerging market, with a GDP per capita of a middle-income economy. China’s increase of OFDI (from barely visible at the turn of the century to second-highest in 2018) demonstrates an aggressive focus on the overseas expansion of their companies.

Additionally to OFDI, China’s competitiveness is also due to timely greenfield investments, aggressive programs to attract Chinese talent amongst the diaspora, and the efforts of state banks to create an ecosystem that supports international expansion.

As Casanova and Miroux argue, “a key aspect behind the dominance of Chinese companies is their ability to establish dominance across large and diverse sectors”. In 2019, four of the top five banks in the world were Chinese and all of the top five construction companies in the world were Chinese as well. Additionally, Chinese companies were also present on the world’s top five in crude oil, and life and health insurance industries.

The impact of COVID-19 on China’s economy and its companies’ competitiveness

However, China’s competitiveness may now be at risk. After growing at 6 percent in 2019, China faced a significant – and unprecedented since 1992 – drop, due to COVID-19 (6.8 percent year-on-year for Q1 2020). Months-long shutdowns of all non-essential activities have had a deep impact on most regions of China. Restrictions on the movement of people, goods and services, and containment measures such as factory closures have cut manufacturing and domestic demand sharply.

Additionally, the decline in production within China has been felt by businesses all around the world, due to China’s key role in global supply chains, as a producer of intermediate goods, particularly in computers, electronics, pharmaceuticals, and transport equipment, and as the primary source of demand for many commodities.

Additionally, the decline in production within China has been felt by businesses all around the world, due to China’s key role in global supply chains, as a producer of intermediate goods, particularly in computers, electronics, pharmaceuticals, and transport equipment, and as the primary source of demand for many commodities.

News reports have confirmed that nearly half a million Chinese companies closed in the first quarter of 2020 due to COVID-19. Looking ahead, in which ways will the pandemic crisis impact the Chinese economy and Chinese firms?

Casanova and Miroux stress that “we have not seen the end of the crisis yet, and new factors may come in. However, the pandemic alters the supply and demand for exports around the world. As a result, the global value chains – and China’s place within it – have already been directly impacted. Faced with an international trade scene that will remain uncertain for a while, China can count on the size and dynamics of its domestic market. This will remain the driving factor for its enterprises for the foreseeable future”.

The IMF forecasts that China’s annual GDP growth rate will barely exceed 1 % in 2020. Compared to China’s track record in the past five years, this is a substantial decline. But compared to what is expected of other economies in the world, where growth is foreseen to fall dramatically, China’s performance will remain relatively impressive.

As of now, we can only wait and see. The crisis and its effects have not fully unfolded yet, and a second COVID-19 wave is expected to hit China and the world. However, as the various Indexes mentioned above have pointed out, China has a strong infrastructure, talent pool, and a coordinated innovation strategy that will help its comeback. Additionally, economic competitiveness drives political power, and as the former United States Treasury Secretary Henry Paulson has written, “The battle is about whose economy will drive the technology of the future and set the standards for it.”

By Carolina Rossini, Co-Founder and CEO, and Joseph Naim, Policy Associate.