China and Kenya are both developing countries that hold promise in terms of technology and innovation. According to the 2020 Global Innovation Index (GII), Kenya is the second most innovative economy in Africa behind South Africa. Overall, China ranks 14th and Kenya ranks 77th in the index. In terms of network readiness, Kenya ranked third in Africa in 2020. In the 2020 Network Readiness index (NRI), China ranks 40th overall and Kenya ranks 82nd. Drawing on GII and NRI analysis, while China’s ICT sector is more prominent, Kenya’s position as a regional leader in technology and innovation holds much promise for future development.

Kenya’s tech scene is one of Africa’s most advanced, yet it differs with China in terms of size of market, degree of industrialization, among other factors. As the figure below shows, there is a substantial gap between the extent to which Kenya and China’s economies are driven by production of information and communications technology (ICT) goods, an important indicator of the degree of technological sophistication of a market. According to UNCTAD data, around 30% of China’s exports are ICT goods, while around only 1% of Kenya’s goods are relevant to ICT. In terms of imports, China also consumes a great deal of ICT goods, which is reflected in the equally high percentage of ICT goods that it imports each year. In contrast, Kenya’s imports of ICT goods is about 5% of the country’s total trade. See chart.[1]

Part of the difference in innovation and technology between the two markets has to do with foreign investment and government policy towards leveraging foreign investment for domestic development. China opened up to foreign investment in the late 1970s, and foreign firms have taken advantage of the more foreign investor friendly policies to set up shop in the country. Microsoft, for example, was one of the early entrants into China, establishing an office in Beijing in 1992. Foreign investment introduced new technologies to China, and created technological spillovers that benefited domestic development of science and technology. In 2019, China officially surpassed the United States of America as the top source of international patent applications filed with the World Intellectual Property Organization (WIPO).

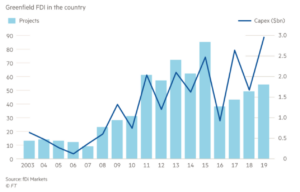

Foreign investment has also played a positive role in technology adoption in Kenya. Kenya has earned the nickname “Silicon Savannah” for its ability to attract foreign investment in information technology. The figure below shows the number of projects and the capital expenditure invested in Kenya by foreign firms. A notable example is in mobile phone use, with 72% of Kenyans having a mobile money account,[2] and 96% of Kenyan households having access to M-PESA, the primary mobile money vendor in the country.[3] However, as research funded by the UK’s Department for International Development shows, government corruption and over-regulation can create business uncertainty for small and medium sized domestic enterprises, and prevent them from benefiting from government policies promoting innovation.[4] In addition, the 2020 GII Report also notes lack of formal financial institutions and weak intellectual property protection as constraints for financial capital to fund innovation in Kenya.

In 2008, President Mwai Kibaki launched the ‘Kenya Vision 2030’, which “aims to transform Kenya into a newly industrializing, middle-income country” by 2030. The Economist’s Intelligence Unit forecasts that Kenya’s goal of transforming its economy into one similar to that of emerging economies (like China’s) is attainable, albeit with a longer timeline, and only if the government carries out institutional and structural reforms. The quality of governance institutions is also one of the five pillars of the GII, with Kenya currently ranking 78th globally. Kenya’s future in technology and innovation is one that holds great promise, but also one that holds challenges for institutional reform.

With the COVID-19 pandemic, the digitization of economic activity has accelerated, and technology-driven solutions for combating the disease are being deployed in communities in Kenya. While attaining industrial capacity and scale in ICT production – as China has done over the past few decades – might be further down the road for Kenya, its many ventures and technologies adopted locally may bring about transformational change to the country in due time.

–

[1] Note: UNCTAD data for Kenya is missing for 2011, 2013, and 2014.

[2] Financial Inclusion Insights: http://finclusion.org/country/africa/kenya.html#dataAtAGlance

[3] Tavneet Suri and William Jack (December 8, 2016). “The long-run poverty and gender impacts of mobile money.” Science 354 (6317), 1288-1292. doi: 10.1126/science.aah5309; M-PESA is set up by UK’s Vodafone and Kenya’s Safaricom.

[4] Voeten, J., Kinyanjui , B., & Barasa, L. (2015). Kenya: Qualitative study on Innovation in Manufacturing Small and Medium Sized Enterprises (SMEs): Exploration of Policy and Research Issues. Tilburg: Tilburg University.